Calculate Gross Return

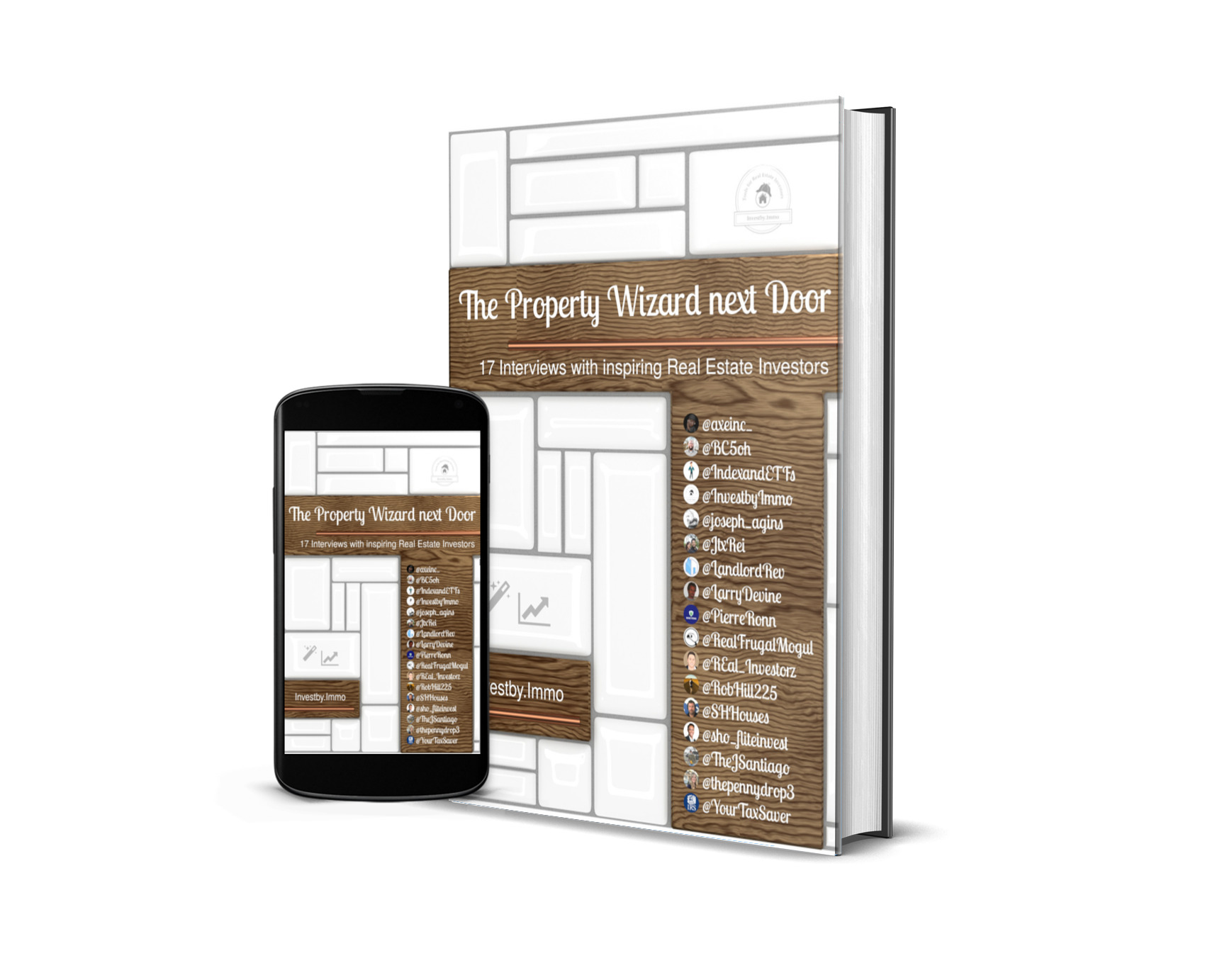

Want to get into Real Estate Investing but don't know how and where to start?

1. Which input parameters do you need to calculate the gross return?

2. What is the basic rent?

3. Why do you need the gross return?

4. How to calculate the gross return?

5. How to interpret the gross return?

6. How high should the gross return be?

- Do I want a property investment to grow my capital using a positive cashflow?

- How important is a long-term increase of the property value to me?

- Are there high costs up front for restorations or repairs?

- Do I need financing and if yes how high are the costs?

- Do I want to have a tax reduction with my property investment?